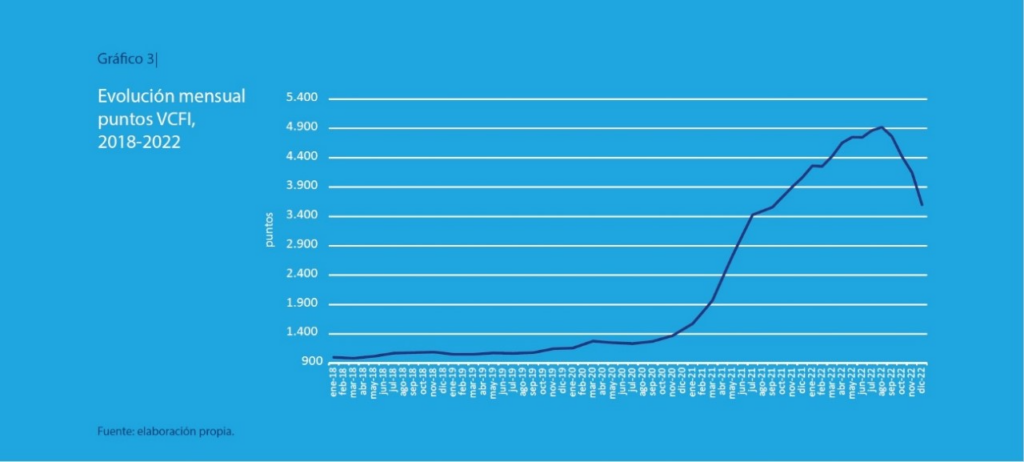

València, 17 April 2023.- The Valencia Containerised Freight Index (VCFI), the indicator that measures the trend and evolution of container transport costs by sea from the Port of Valencia, closed the 2022 financial year at 3,603.07 points, which represents a year-on-year decrease of 11.3% (December 2021 ended with 4,063.59 points). With respect to the start of the historical series in January 2019, the VCFI contemplates an accumulated growth of 260.31%.

In 2022, the VCFI has presented a differentiated behaviour in two stages. Until August, the VCFI registered monthly increases until reaching its record level of 4,918.77 points. However, from September onwards, a sharp fall in the price of export freight was observed until the end of the 2022 financial year with 3,603.07 points, a trend that continued in the first months of this year 2023.

These data have been shown this afternoon in the Clock Building of the Port of Valencia during the presentation of the annual report of the Valencia Containerised Freight Index (VCFI) for 2022. A year that has been marked by the war in Ukraine, the prices of energy and raw materials and high inflation have slowed down the economy in 2022 and the slowdown of world trade, and consequently of maritime transport.

The report was presented by the head of Strategic Planning and Innovation of the Port Authority of Valencia (APV), Juan Manuel Díez and the director of Market Intelligence of the Fundación Valenciaport, Amparo Mestre. The event was also attended by the director of the Valenciaport Chair of Port Economics at the University of Valencia, Vicente Pallardó, and the keynote speech by the expert in transport geography and professor at Hofstra University (New York), Jean-Paul Rodrigue.

Decrease in all areas analysed by VCFI

When analysing the freight rates of the main sub-indices of the VCFI (Western Mediterranean, Far East and USA & Canada), an upward trend is observed in the first half of the year 2022, while in the second half of the year the drop in freight rates is generalised for the three areas, in line with the evolution of the VCFI at a global level.

Thus, in the case of the Far East, the Index ended the year at 2,372.04 points which represents a decrease of 36.6% compared to December 2021 which closed at 3,742.98 points. A downward trend that continues at the beginning of 2023. This decline is due to the general slowdown in the Chinese economy as a result of changes in global consumption patterns after the pandemic and reduced demand for products from the Asian country due to high energy prices, rising interest rates, sustained inflation and the negative effects of the war in Ukraine.

In the Western Mediterranean, the VCFI ended 2022 at 1,897.94 points compared to 2,117.26 in 2021, a decrease of 10.4%. It remains in this line at the beginning of 2023, which shows a slight decrease in the first four months.

Complex economic situation

The economic environment in 2022 has been complex and marked by a generalised slowdown in economic activity, more pronounced than expected, and with the highest inflation in decades. To this effect, the cost-of-living crisis, the tightening of financial conditions in most regions, Russia’s invasion of Ukraine and the persistence of the pandemic in some areas have all contributed to the economic slowdown.

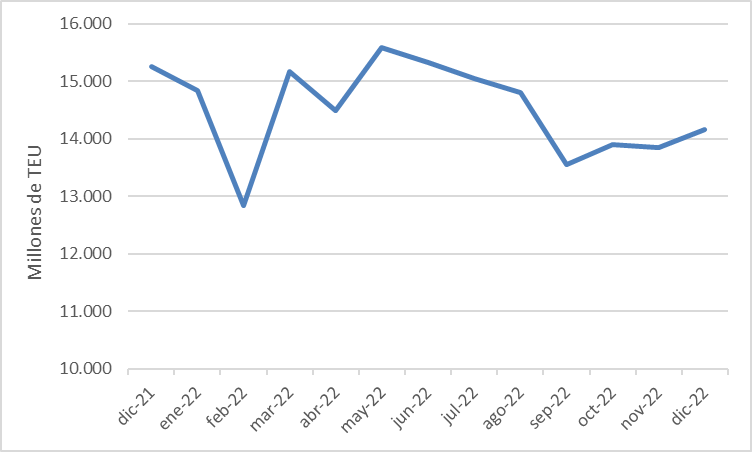

This situation has translated into a slowdown in international trade during the second half of the year, and consequently in the demand for goods handled by sea, with the result that the overall volume of port traffic has decreased, especially in the second half of 2022. Thus, the demand for TEUs (standard 20-foot containers) for the whole of 2022 has fallen by 3.9%, according to Container Trade Statistics.

The VCFI Annual Report indicates that in 2022 shipping lines have maintained high capacity deployed to meet demand in the first half of the year, employing almost all available vessels, so that the commercially idle fleet has been kept at minimums and restricted in most cases to operational causes. However, during the second half of the year, weakening cargo demand and carriers’ announcements on the suspension of shipping on some of the main east-west trade lanes, together with the “Golden Week”, led to a significant increase in containership idleness.

An important factor resulting from the interplay between supply and demand in shipping is the level of port congestion, due to its impact on global supply chains. After two years of widespread port congestion, waiting times have shown clear signs of improvement in the second half of 2022, showing a downward trend in China, the United States and Europe, although not quite reaching pre-pandemic figures.

Risk management

The conference featured a presentation by Jean-Paul Rodrigue, professor at Hofstra University (New York), who analysed the maritime economy in 2022. During his presentation, Jean-Paul Rodrigue indicated that “the convergence observed between supply chains and maritime transport, and the divergence in port growth rates that has been observed since 2020, encourage us to consider resilience and risk management as a central axis for the coming years”.

The Hofstra University professor cited some of the most frequent risks as “the macroeconomic context and the uncertainty of China’s role in global supply chains are in a paradigm shift; the decarbonisation that ports and shipping are implementing with investments in new technologies and fuels; the challenge of assessing future global and regional demand for the maritime industry; or the risk of the application of information technologies in the sector”.